Best Way To Save Receipts

Yes the irs can come knocking for documentation and audit you up to six years back in some cases.

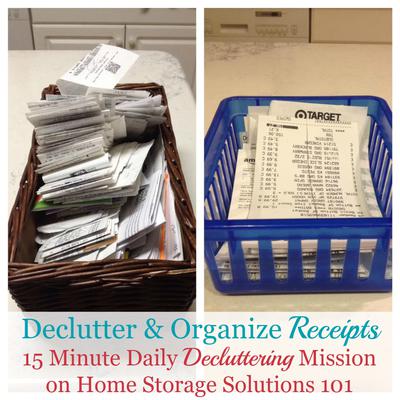

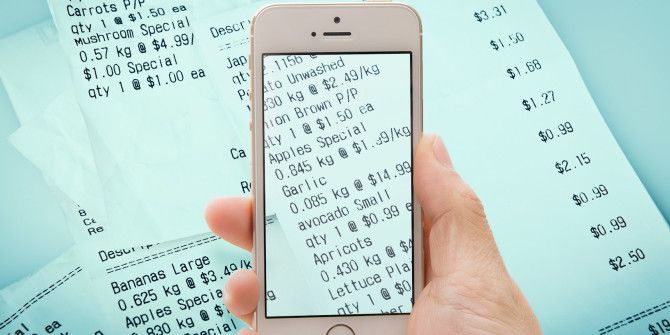

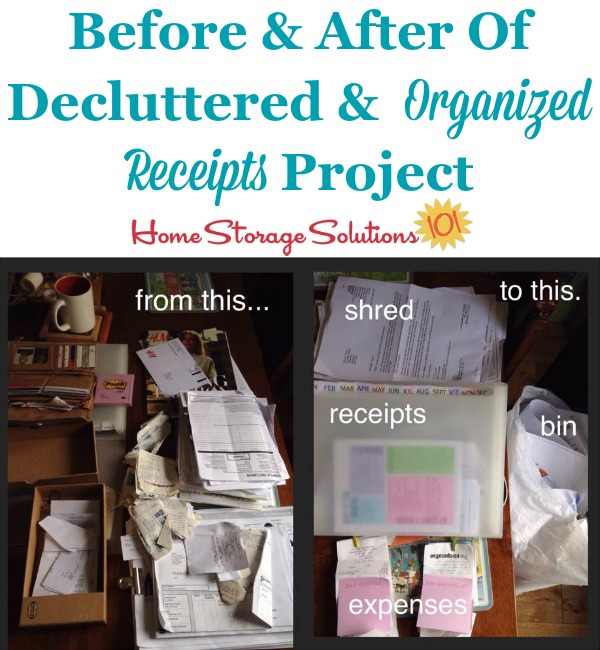

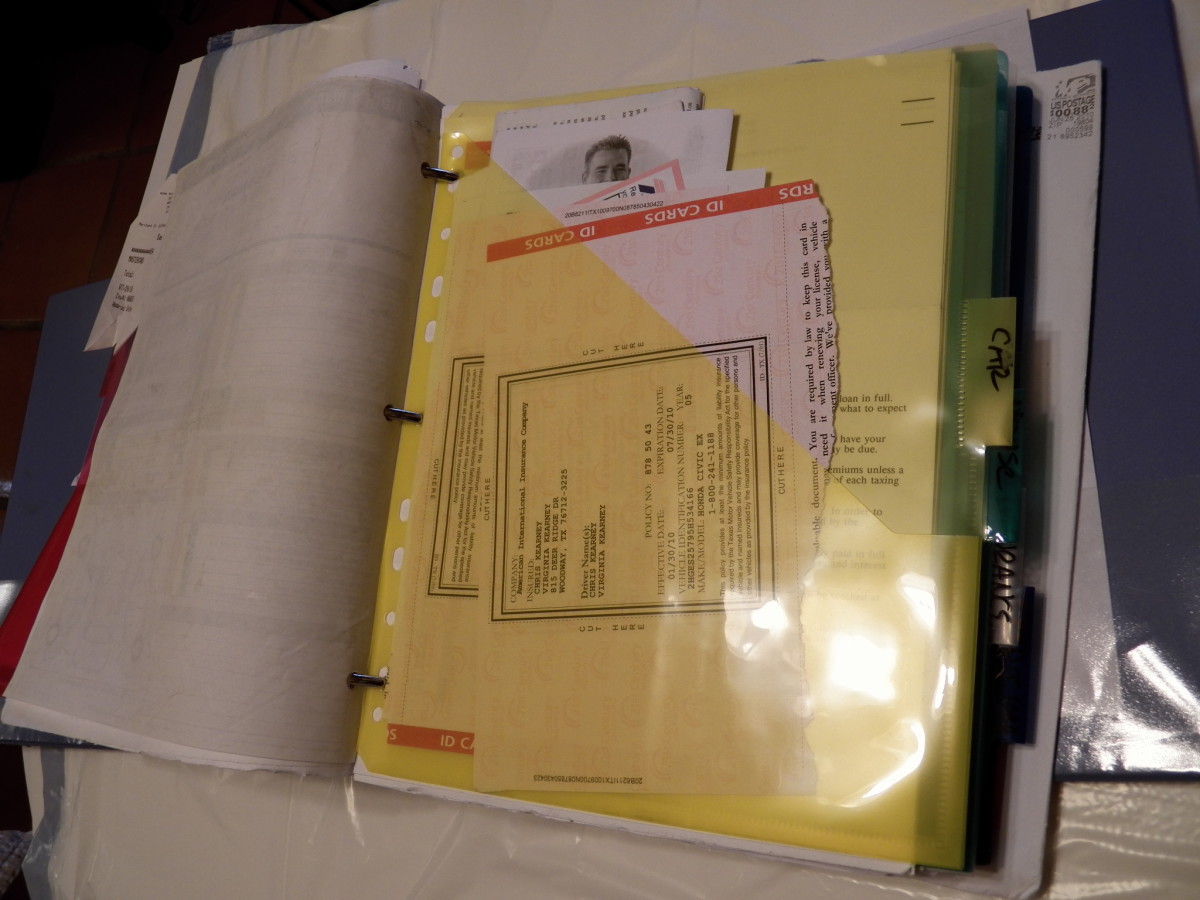

Best way to save receipts. Take a photo of your receipt using your smart phone and the item will be stored onto your account. Buy color coded folders to store your receipts and documentation so you can easily find the documentation you need later. Scan and save them. 4 easy ways to keep track of receipts 1.

Scan receipts and keep them at least six years. Neat lets you use your phone to scan in receipts or mail in paper copies using their magic envelopes. However hoping that the ink on your home depot receipt hasnt faded away is a whole other issue. How to save your receipts using your desktop chrome browser immediately after you make a purchase click on print or hit ctrl p.

Use an app to such as onereceipt can help you keep your receipts without actually having to pile them up. Shred your receipt once you know it is saved. While this program isnt made specifically for cataloguing receipts. There are so many different ways to keep your receipts and paperwork organized for your small business but neat is the 1 top tool that i love recommending to my clients.

You will not print a physical copy. If you like simple grids and avoid fancy apps this is. That means youll avoid sitting down to do your taxes during tax season and realizing you need to track down months old documentation. Keep receipts for major purchases any item whose replacement cost exceeds the deductible on your homeowners or renters insurance.

For extra credit you can add a piece of washi tape on the front as a label. Shortly after the end of the calendar year you will probably be able to throw out or more safely shred a slew of additional paper including your paycheck stubs. This is a great way to corral those receipts and keep them around but doesnt require a ton of time to create or maintain. Whether you want to store receipts in the cloud use a mobile app or scan and store your receipts any one of these options will help you complete expense reports faster document tax deductible expenses keep insurance records or manage receipts for any reason.

The irs allows taxpayers to scan receipts and store them electronically. You will be printing directly. Its also the only app discussed in this article that is not free. Neatreceipts figure a is the app i use to keep up with all my receipts.

And unlike the other apps on this list neatreceipts is pc based. This is an iphone android and ipad app that also has a desktop feature. All you need is a large canister we love this one to drop in important receipts.