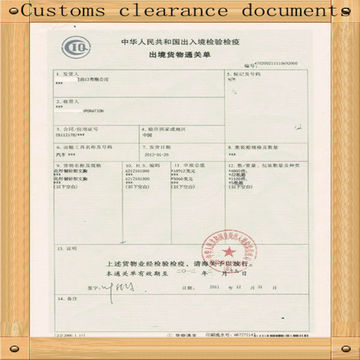

Custom Clearance Certificate

The handbook on customs clearance hereinafter referred to as the handbook is presented by the.

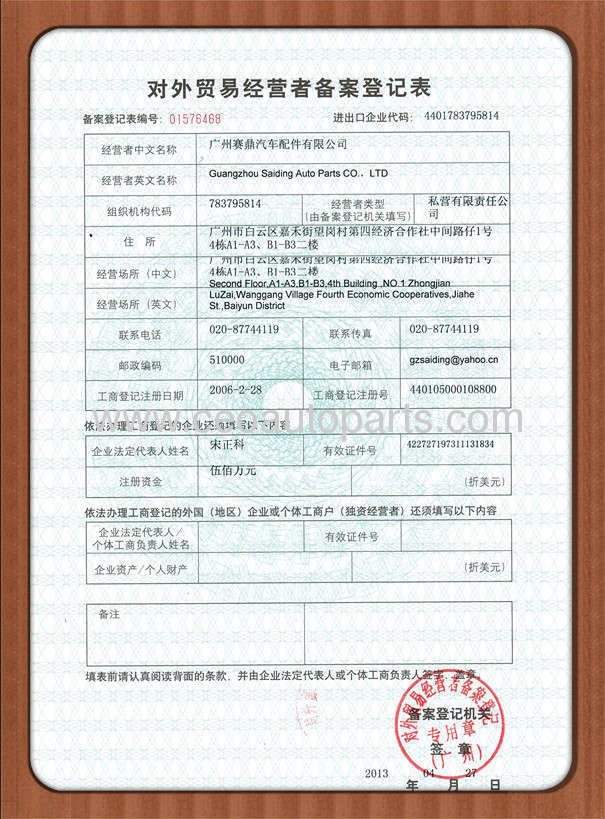

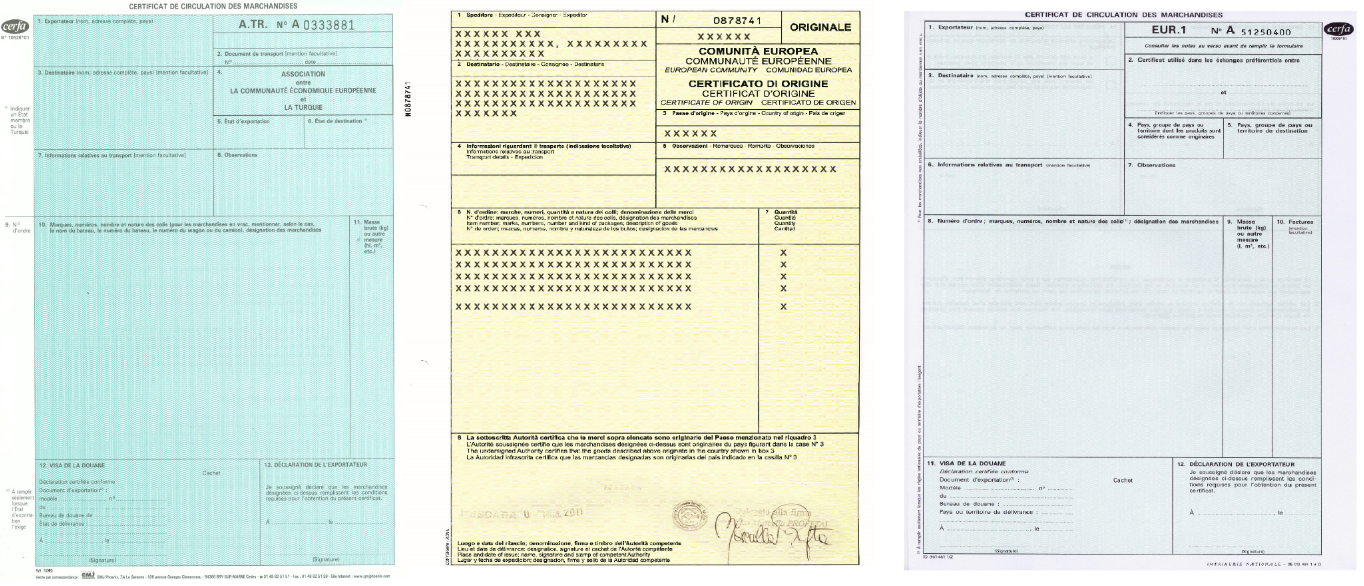

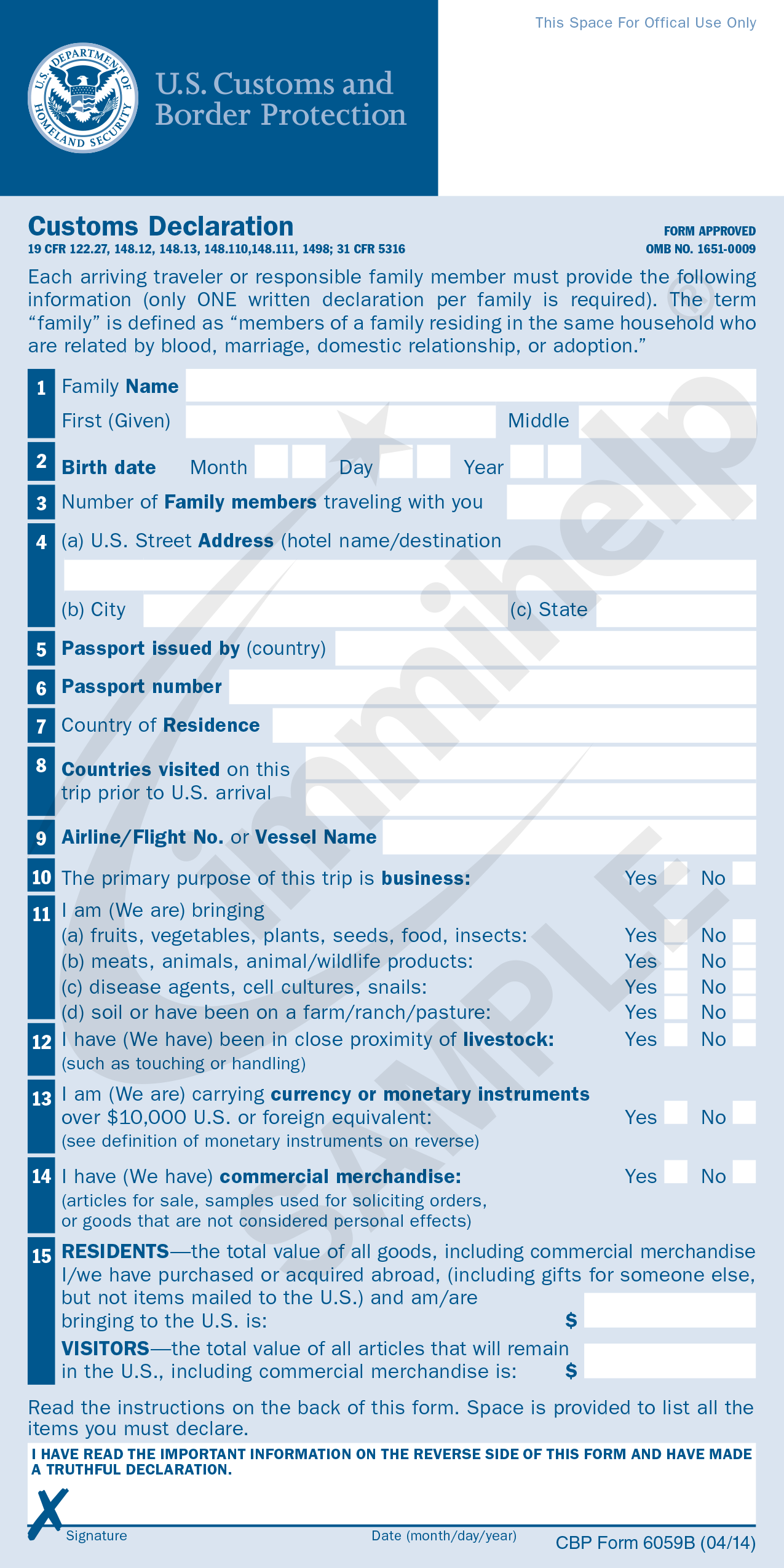

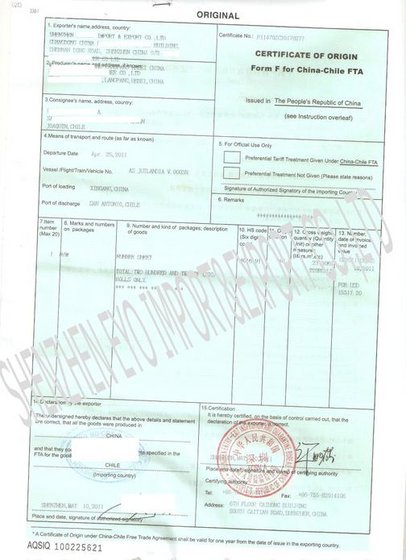

Custom clearance certificate. So government insist an import license as one of the documents required for import customs clearance to bring those materials from foreign countries. Customs clearance work involves preparation and submission of documentations required to facilitate export or imports into the country representing client during customs examination assessment payment of duty and co taking delivery of. The commercial invoice is the most import for import customs clearance. Companies frequently assume that their products do not require certification or qualify for certain exemptions and thus expect to clear customs without any.

Commercial invoice used for valuation purposes and calculation of the assessable value. Including an accurate description of your shipments contents is essential for timely customs clearance. Co certificate of origin cpf customs processing fee cq certificate of quantity crdb cambodia rehabilitation and development board crmds customs risk management database system. Inaccurate or vague shipment descriptions are one of the most common reasons for customs delays.

Management study guide provides information that gives one a better idea of what customs clearance entails. Include consistent detailed descriptions on all documents to help keep your shipment on track.