How To Keep Receipts For Business

:max_bytes(150000):strip_icc()/hand-of-businesswoman-checking-invoice-1024095528-ff3decc5a30e44ab8119f6d2176ee1fd.jpg)

The irs allows taxpayers to scan receipts and store them electronically.

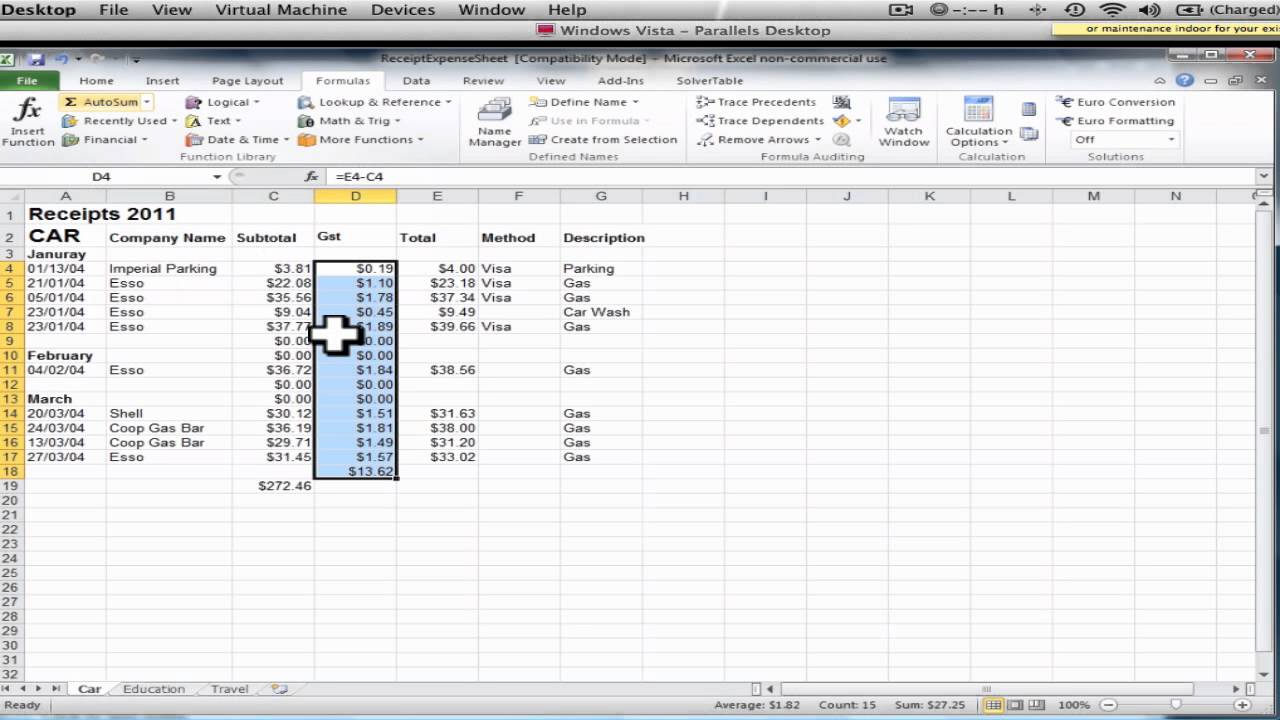

How to keep receipts for business. The answer is yes you do have to keep employee expense receipts. This is a great way to corral those receipts and keep them around but doesnt require a ton of time to create or maintain. However hoping that the ink on your home depot receipt hasnt faded away is a whole other issue. That means more money back in your pocket to invest in your business or to spend however you want.

In some cases the government may look further back into your records. They are an important part of your bookkeeping and tax records. Here are some tools that can make digital recordkeeping easier. The more legitimate deductions you can take the lower your taxable income will be.

You should keep supporting documents that show the amounts and sources of your gross receipts. For instance organize them by year and type of income or expense. Keep your business receipts for at least three years in case you need to show proof of purchases or sales. Scan receipts and keep them at least six years.

The irs suggests saving your receipts and records for at least four years but keep in mind that the irs can still come knocking on your door if you failed to report more than 25 of your businesss gross income income before expenses are taken out six years after you file a return. The following are some of the types of records you should keep. The general rule of thumb is to keep business receipts for as long as the irs can audit your records. Gross receipts are the income you receive from your business.

The irs is not a big fan of estimating your expenses. The more you can lower your taxable income the fewer taxes youll pay. For extra credit you can add a piece of washi tape on the front as a label. We recommend scanning every record and receipt in your business tagging it with a descriptive name and archiving it forever.

It keeps you organized keeps you on budget and can be a big money saver when you file deductions at tax time. Benchyou can upload all your receipts and store them in the bench app with no storage limits. Keeping track of receipts for your small business is very important. All you need is a large canister we love this one to drop in important receipts.

A better system is required for when its time to do bookkeeping rather than stuffing all of your business receipts into a desk drawer. You should keep them in an orderly fashion and in a safe place. If you are going to claim a. Of course discovering a disorganized mass of receipts can create a mess of trouble.

Not only will keeping a record of your employee expenses ensure you are meeting the requirements of the irs it will also benefit your business. Usually the irs audits three years worth of records. You want to keep your business receipts because nearly every business expense is deductible.