Irs Payment Receipt

Supporting documents include sales slips paid bills invoices receipts deposit slips and canceled checks.

Irs payment receipt. You can only submit one payment at a time using irs direct pay. Can i set up recurring payments using irs direct pay. These documents contain the information you need to record in your books. However your payment is due regardless of direct pay availability so please plan ahead to avoid penalties and interest.

Always print copies of form 1040 es when you mail a check payment and file with your other tax receipts for the year so the information will be easily accessible when filing your tax return. Please allow up to 5 minutes after processing for your payment to display in payment verification. Yes with irs direct pay you can select the current date and get credit for your payment today. You should print out the digital receipt and keep it with your tax records as it contains your confirmation number.

Penalties and interest may apply to money you owe after the due date. Tax payment peace of mind. Pay your taxes view your account or apply for a payment plan with the irs. Payments internal revenue service.

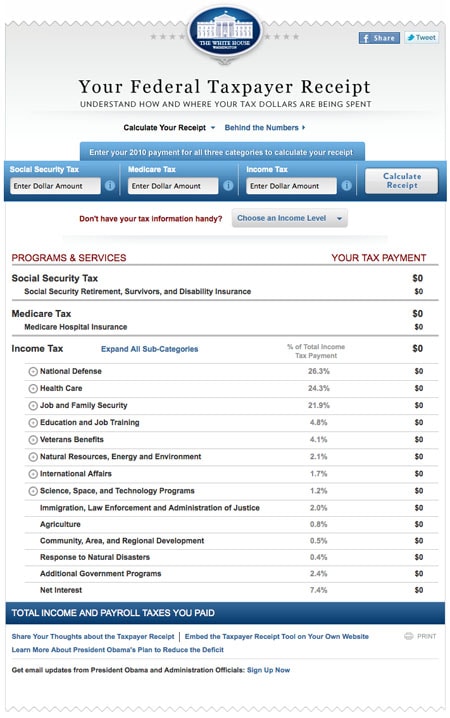

The tax class mft code and document code dc will be derived according to the specific document being processed. Payment verification pay1040s payment verification system allows you to retrieve your electronic receipts from prior federal tax payments made through our system. Use this secure service to pay your taxes for form 1040 series estimated taxes or other associated forms directly from your checking or savings account at no cost to you. You can easily keep track of your payment by signing up for email notifications about your tax payment each time you use irs direct pay.

Paying the irs with a debit card is now faster and less expensive than sending a check via certified mail with a return receipt. It is important to keep these documents because they support the entries in your books and on your tax return. The tax class and master file tax account code mft are the same as for the original return.