Irs W2 Printable Form

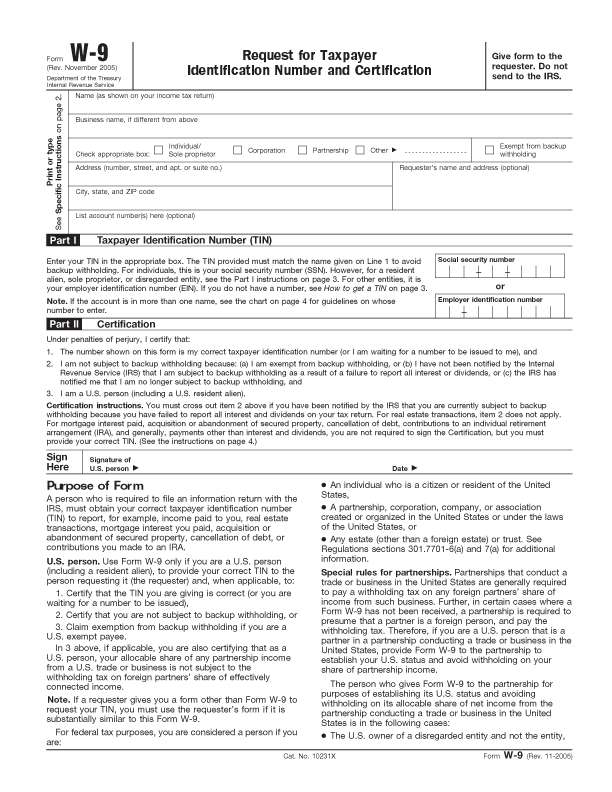

You can find free fillable federal tax forms at the website of the irs or you can use online tax filing to supply the correct tax forms for you automatically.

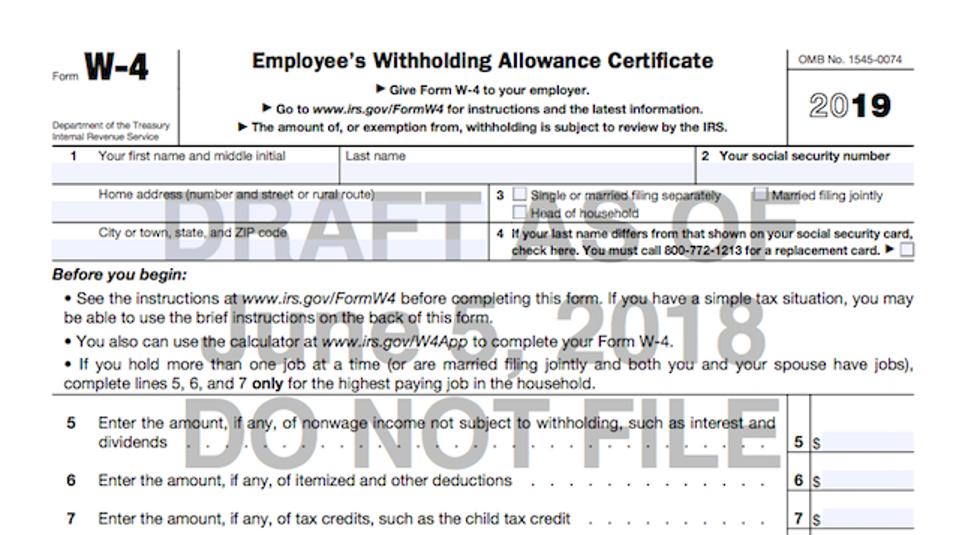

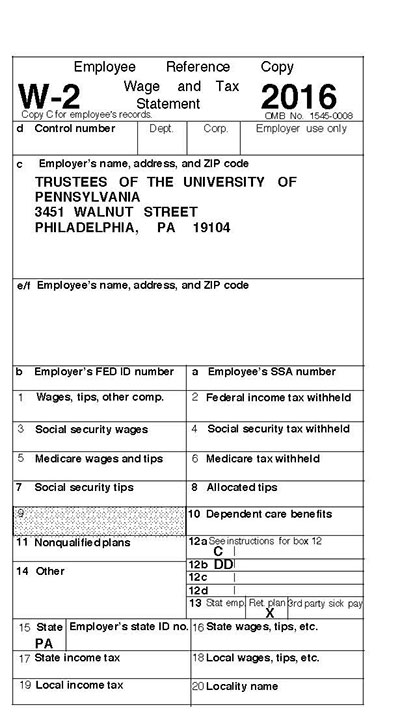

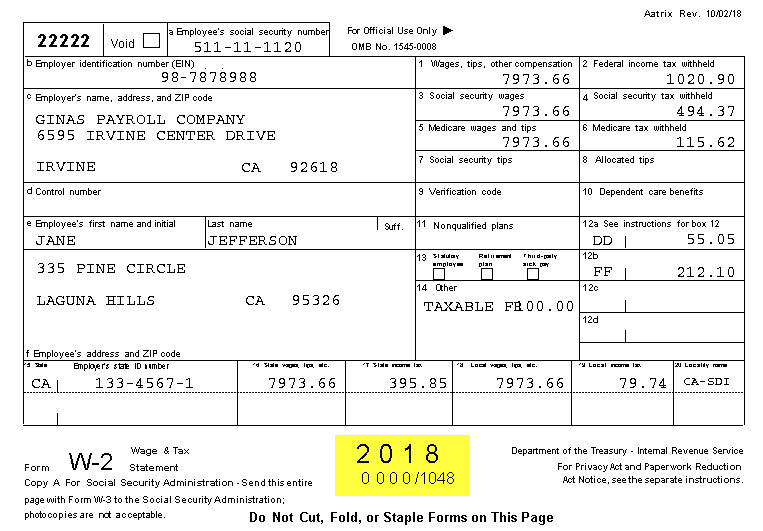

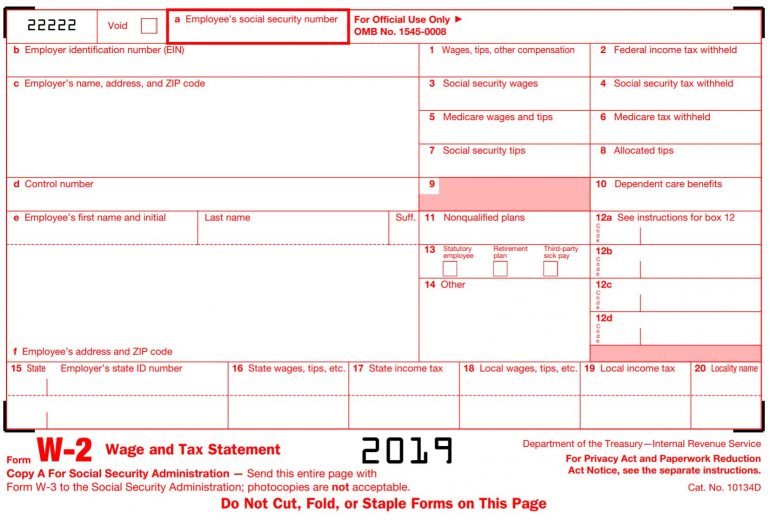

Irs w2 printable form. Wage and tax statement. Also use form w 2 c to provide corrected form w 2 w 2as w 2cm w 2gu w 2vi or w 2c to employees. Form 4137 social security and medicare tax on unreported tip income form 8027 employers annual information return of tip income and allocated tips form 8850 pre screening notice and certification request for the work opportunity and welfare to work credits. Form w 2 is intended for wage and tax statement.

Information about form w 2 g certain gambling winnings including recent updates related forms and instructions on how to file. About form w 2 as american samoa wage and tax statement. Wage and income transcripts are available for up to 10 years but current tax year information may not be complete until july. Allow 10 business days from the irs received date to receive the transcript.

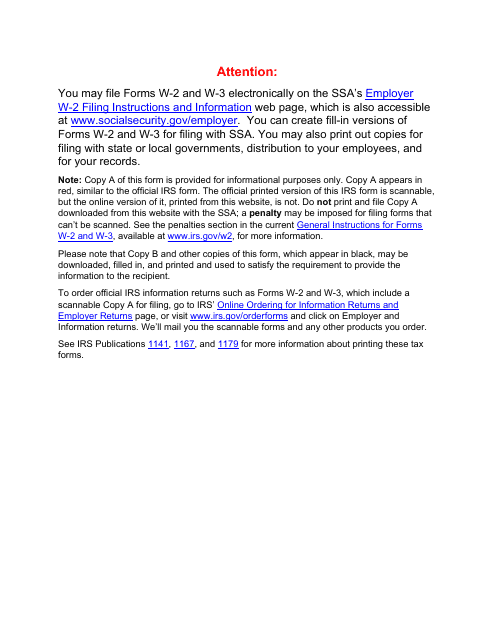

You can be assured you are preparing and filing the correct tax form by using online tax software. Use form w 2 c to correct errors on form w 2 w 2as w 2cm w 2gu w 2vi or w 2c filed with the social security administration ssa. Department of the treasuryinternal revenue service. This information is being furnished to the internal revenue service.

In this form an employer provides detailed information about the amount he paid to employees and deducted taxes. Information about form w 2 wage and tax statement including recent updates related forms and instructions on how to file. Copy bto be filed with employees federal tax return. Check the box for form w 2 specify which tax years you need and mail or fax the completed form.

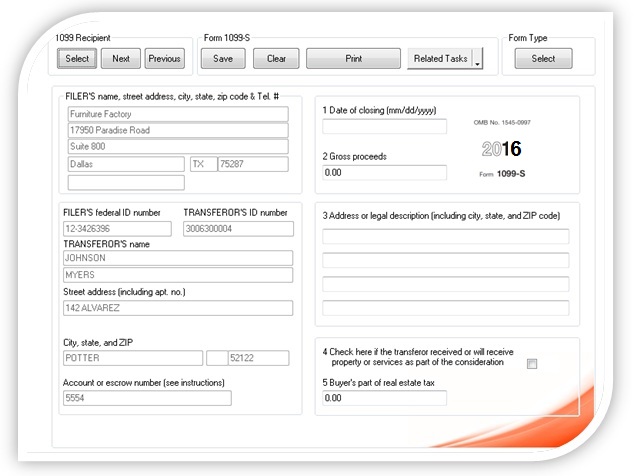

File this form to report gambling winnings and any federal income tax withheld on those winnings.

:max_bytes(150000):strip_icc()/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)