Mileage Invoice Template

The best quickbooks invoice templates will include all the pertinent details you need to provide your customer so you can get paid.

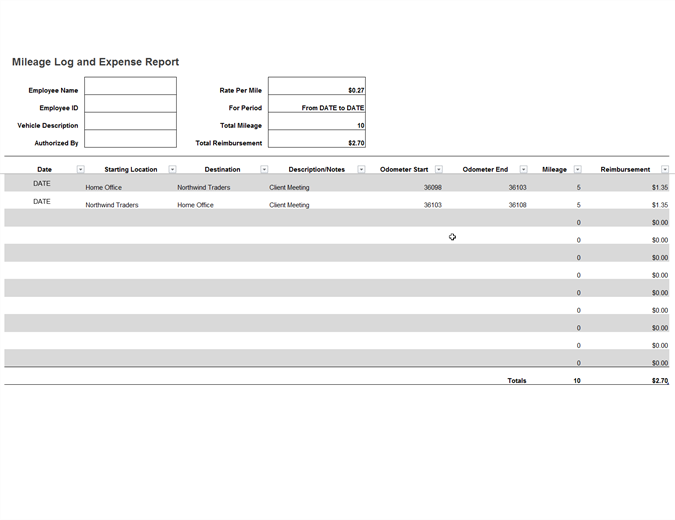

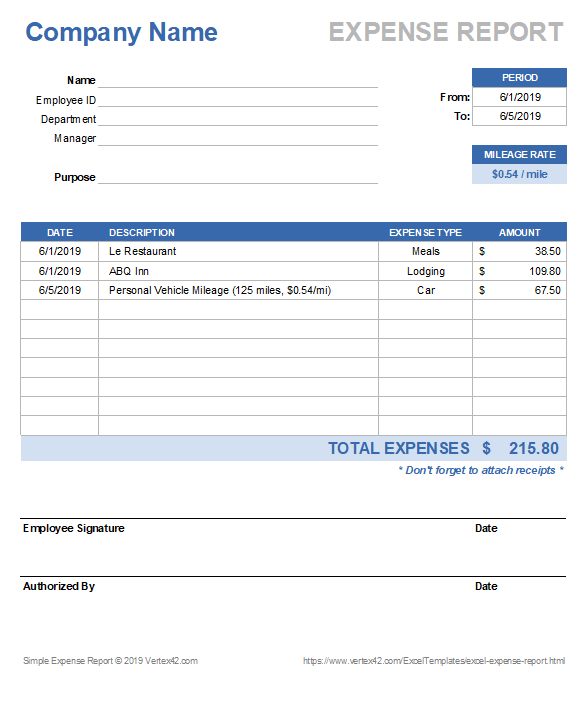

Mileage invoice template. The irs as you would expect will not just rely upon your word and will need some evidence of the business mileage. The bill is the last component of your sales deal that should get enrolled in the mind of the client. Mileage log and expense report. Destinations that are often reimbursable include conventions client visits work specific errands to and from airports for business travel driving to take clients to dinnerslunches non permanent job.

Quickbooks online invoice templates help you save time and bill customers faster. This includes a detailed description and cost of productsservices payment due date and your contact details should they have questions. The invoice is usually dated with the companyindividual logo along with a description of the productservice provided in a line by line setting. Employees who travel for business can use this mileage invoice to recoup expenditures for gas miles and accommodation on business trips.

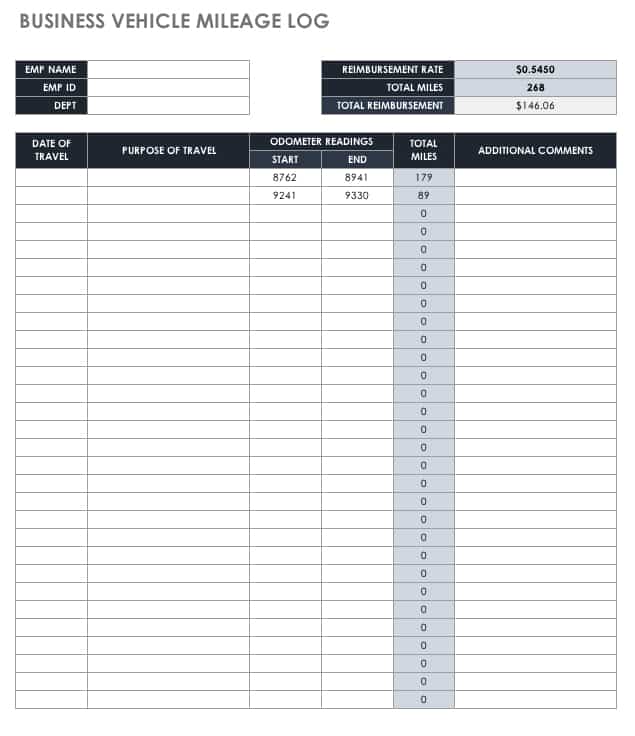

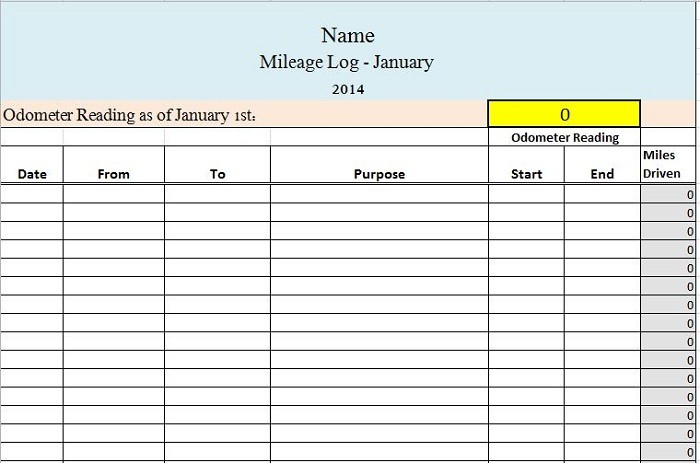

Use the vertex42s mileage tracker to keep track of your business mileage purpose and notes. Free to download and print. Comprehensive microsoft word templates repository to download hundreds of free word templates including resume calendar invoice receipt agenda letter form and many other templates. While integrated with invoice manager for excel namely uniform invoice software it is a fairly simple ready to go billing and invoicing system.

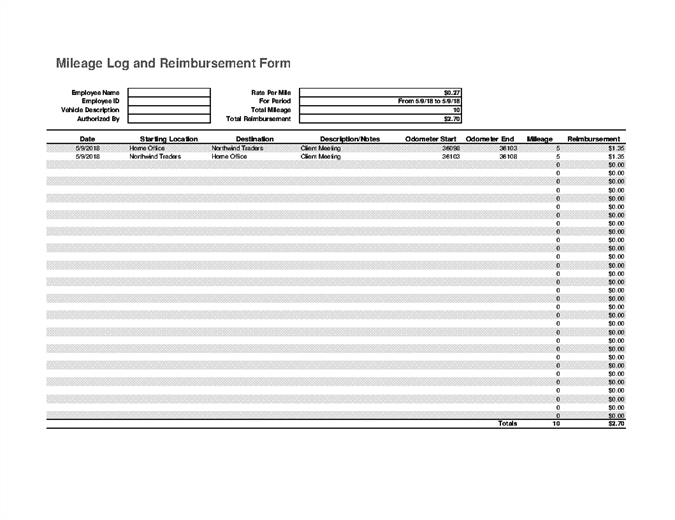

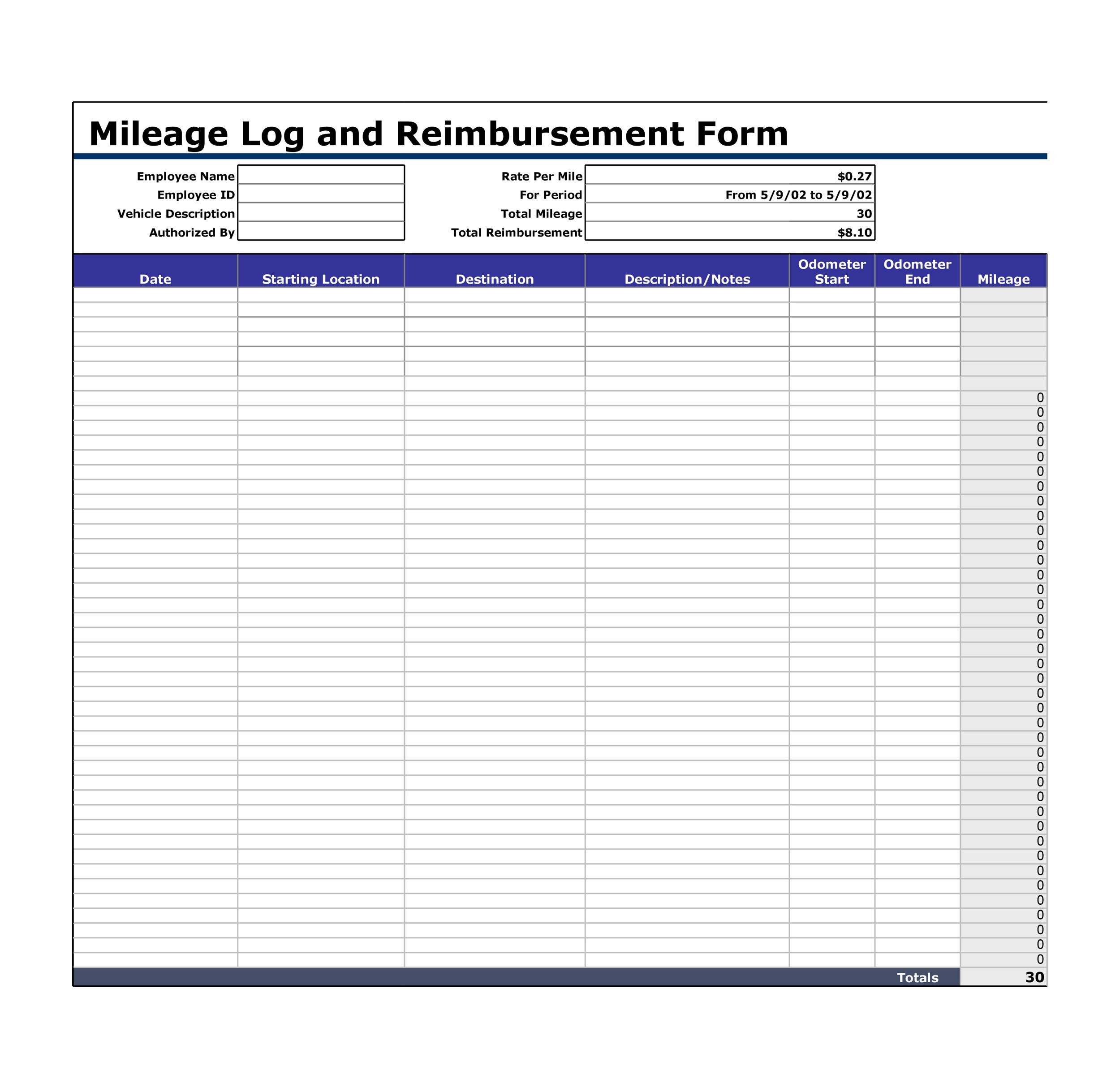

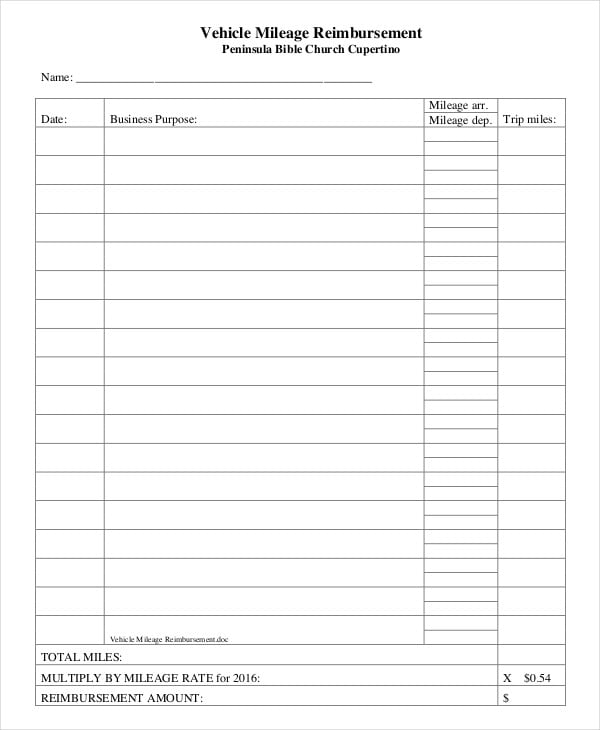

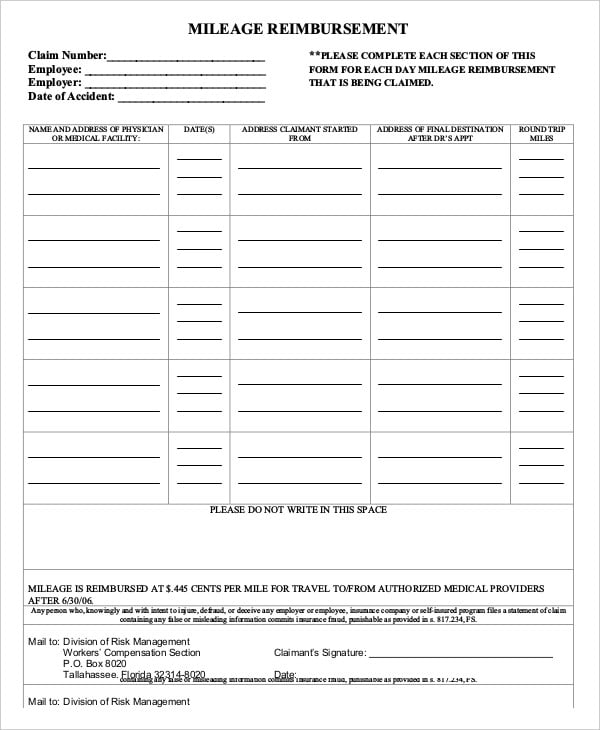

Mileage and reimbursement amounts are calculated for you to submit as an expense report. A mileage reimbursement invoice is given by a business or charity employee to their employer for the purpose of collecting compensation for the miles driven to a location required for work. To create invoices using this template basically you plug in date time worked pre determined hourly or day rate select a project nameid input mileage and expenses and print an invoice. Employees who travel for business can use this mileage invoice to recoup expenditures for gas miles and accommodation on business trips.

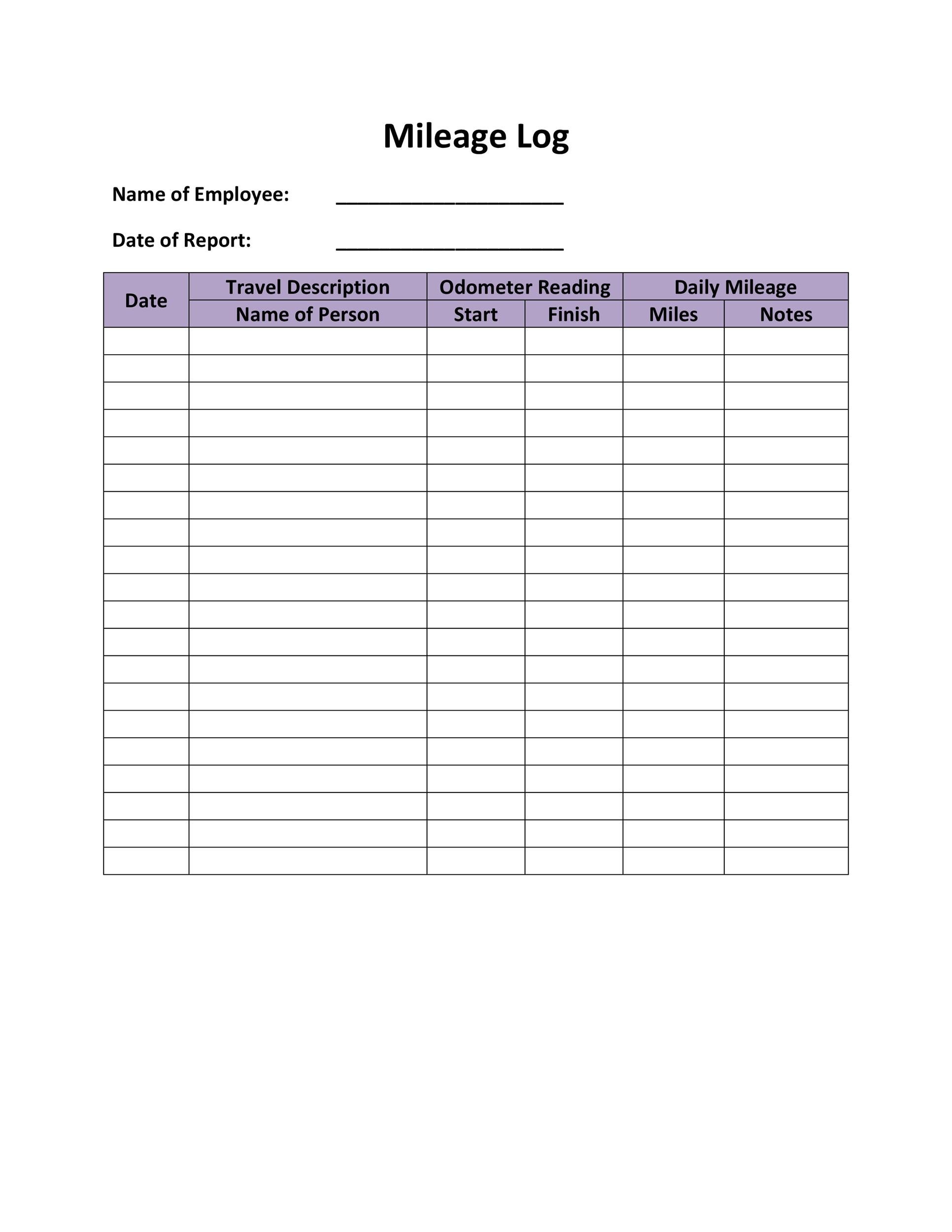

The template will also help you to calculate the amount you are owed. If your company has a specific reimbursement form for you to use then keep a copy of vertex42s mileage tracking log in your car to track mileage at the source. For a mileage log sheet to be valid for irs use it must contain some details. Your mileage log sheet must indicate the following.

Report your mileage used for business with this log and reimbursement form template.