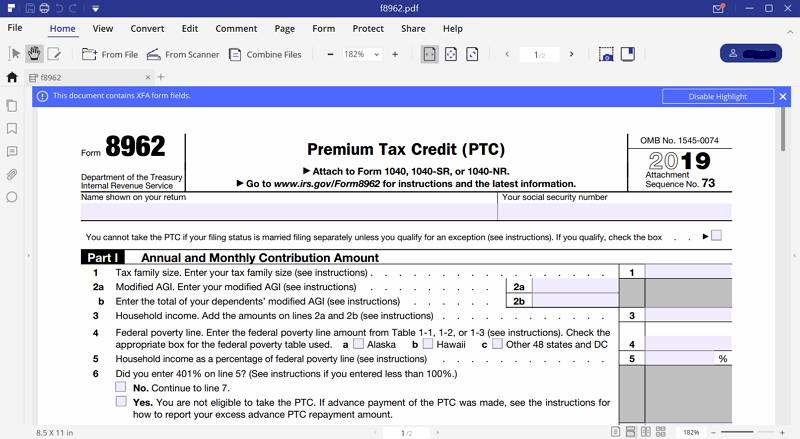

Printable Form 8962 For 2019

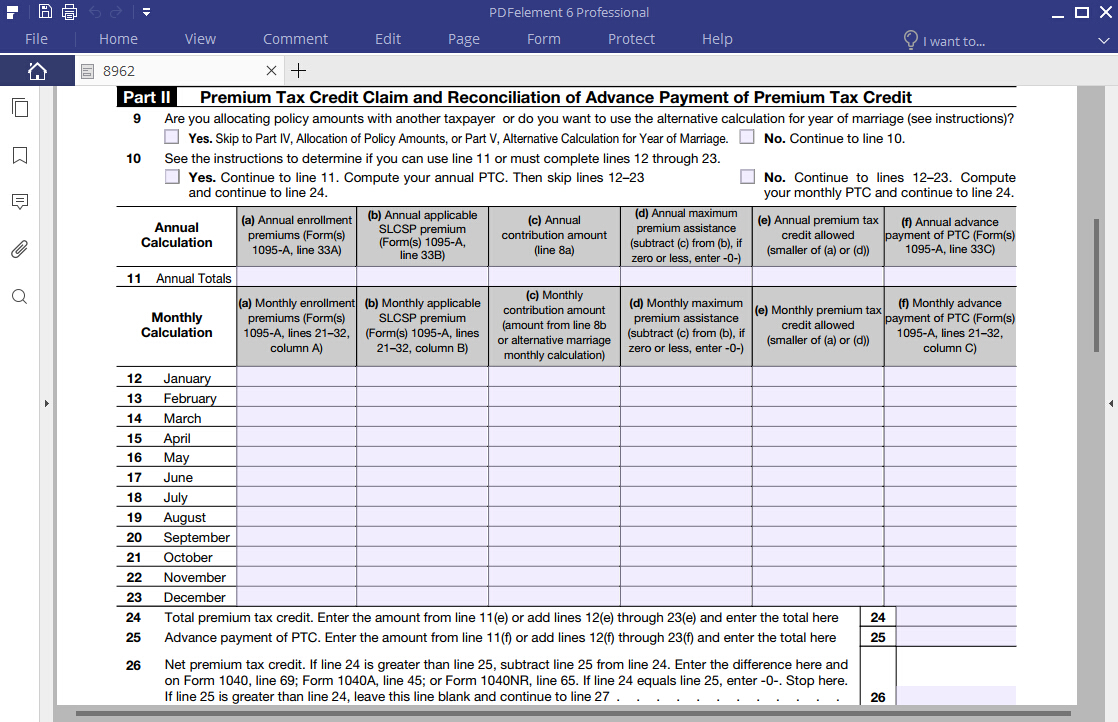

Form 8962 premium tax credit is required when someone on your tax return had health insurance in 2019 through healthcaregov or a state marketplace and took the advance premium tax credit to lower their monthly premium.

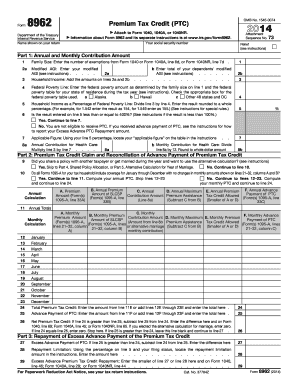

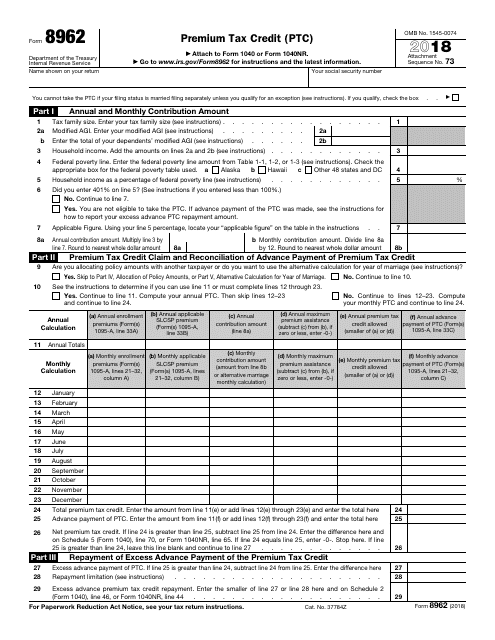

Printable form 8962 for 2019. Complete the following information for up to four policy amount allocations. Allocation of policy amounts. Form 8962 premium tax credit is required when someone on your tax return had health insurance in 2018 through healthcaregov or a state marketplace and took the advance premium tax credit to lower their monthly premium. After completing the application fee process you can print your application form and save this for the future referencefootnotes1 uksssc application form.

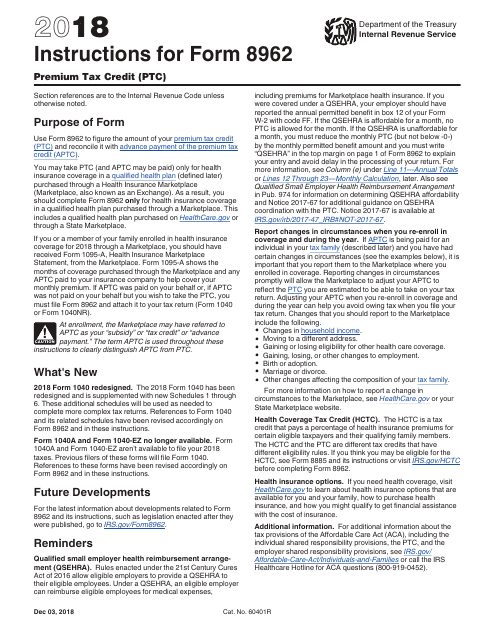

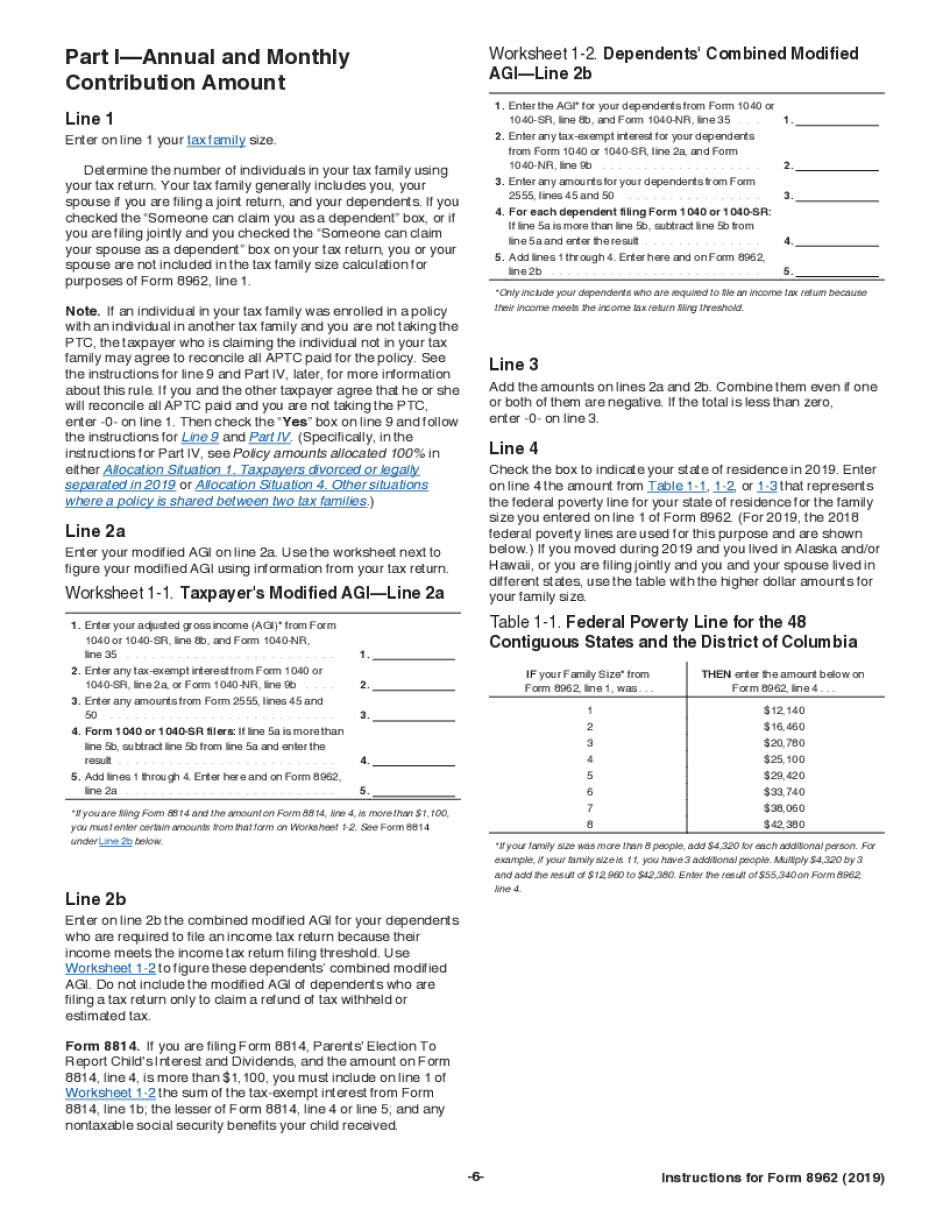

If necessary print out the document. Premium tax credit ptc 2019 12032019 inst 8962. More about the federal form 8962 other ty 2019 we last updated the premium tax credit in february 2020 so this is the latest version of form 8962 fully updated for tax year 2019. Printable 2019 federal tax forms are listed below along with their most commonly filed supporting irs schedules worksheets 2019 tax tables and instructions for easy one page access.

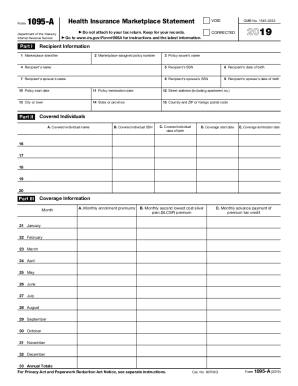

Form 8962 is taken from the information on your 1095 a. If you entered 401 on form 8962 line 5 excess aptc was paid and you are eligible for the alternative calculation. See instructions for allocation details. You can download or print current or past year pdfs of form 8962 directly from taxformfinder.

Download the created irs 8962 form to your device and forward it via email fax or sms. Instructions for form 8960 net investment income tax individuals estates and trusts 2019 02102020 form 8962. Premium tax credit ptc 2019 12032019 inst 8962. If you entered 400 or less on form 8962 line 5 continue to worksheet 3 to determine whether excess aptc was paid during 2019.

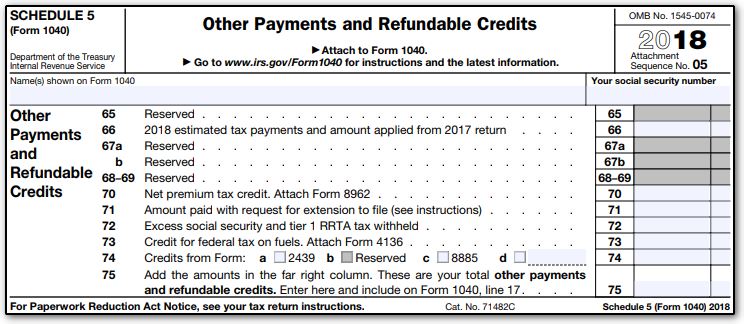

For most us individual tax payers your 2019 federal income tax forms are due on april 15 2020 for income earned january 1 2019 through december 31 2019. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit. Instructions for form 8962 premium tax credit ptc. Form 8962 2019 page.

Do not complete worksheet 3. Product number title revision date posted date. Instructions for form 8962 premium tax credit ptc 2019 12032019 form 8963. You can print other federal tax forms here.

30 a policy number form 1095 a line 2 b ssn of other taxpayer c allocation start month d.