Printable Form 8962

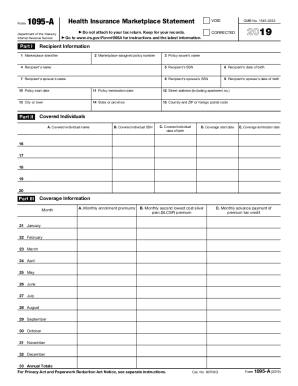

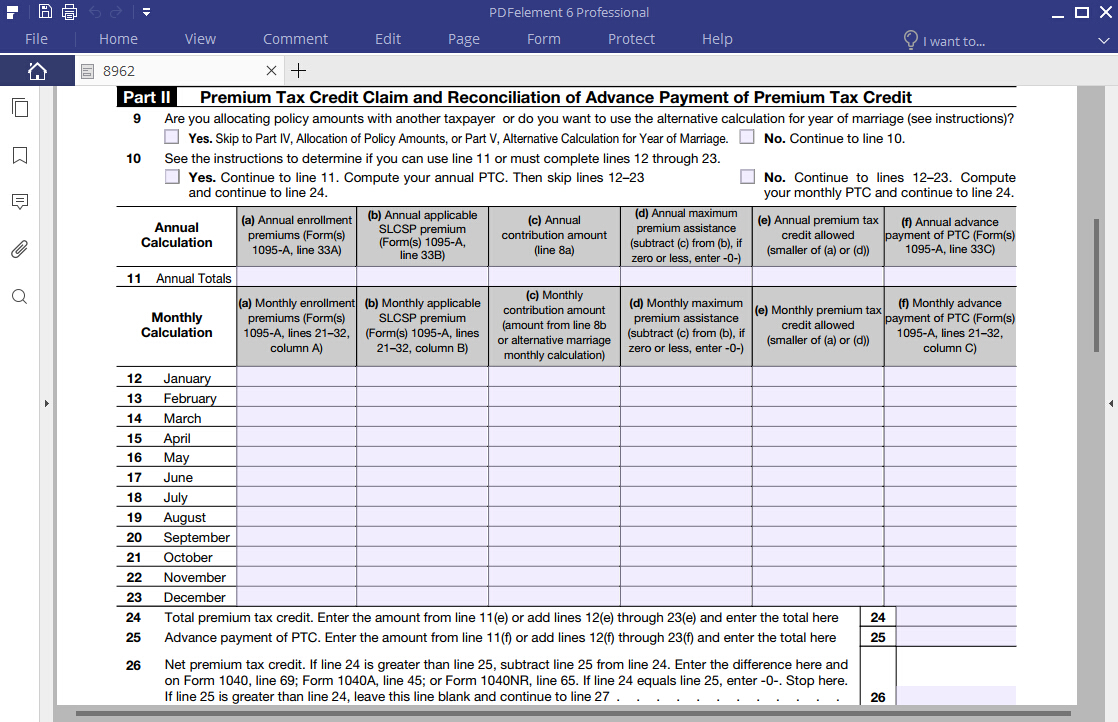

Add all allocated policy amounts and non allocated policy amounts from forms 1095 a if any to compute a combined total for each month.

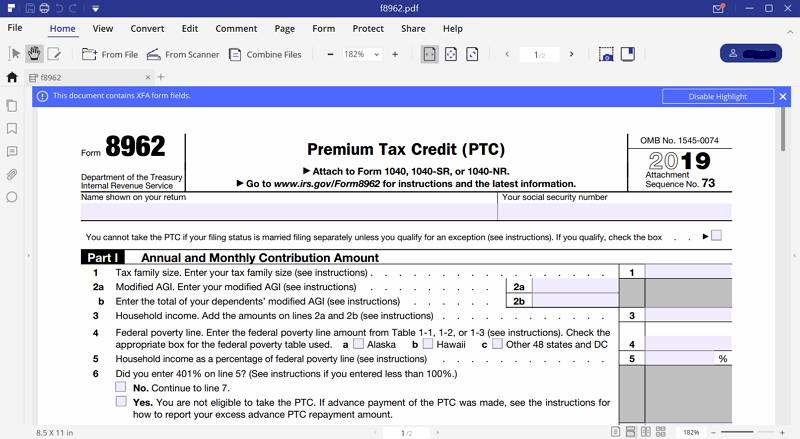

Printable form 8962. An individual needs 8962 form to claim the premium tax credit. Add all allocated policy amounts and non allocated policy amounts from forms 1095 a if any to compute a combined total for each month. Premium tax credit 2019 form 8962 form 8962 omb no. Multiply the amounts on form 1095 a by the allocation percentages entered by policy.

To speed the process try out online blanks in pdf. Department of the treasury internal revenue service issued form also known as the premium tax credit ptc. You can apply digital irs form 8962 to learn your ptc amount. Steps to fill out online 8962 irs form.

A pdf of the latest irs form 8962 can be downloaded below or found on the us. It is used to report your credit amount on your tax return and reconcile the advance credit payments made on your behalf. Department of the treasury internal revenue service forms and publications website. Enter the combined total for each month on.

Form 8962 department of the treasury. Figure the amount of your premium tax credit ptc. Multiply the amounts on form 1095 a by the allocation percentages entered by policy. Form 8962 is used either 1 to reconcile a premium tax credit advanced payment toward the cost of a health insurance premium or 2 to claim a premium tax credit.