Social Security Worksheet For Taxes

How much tax will i owe on my social security benefits.

Social security worksheet for taxes. Box 5 of all your forms ssa 1099 and forms rrb 1099. If you were married file. Enter the total amount from. The answer is more complicated than you might think.

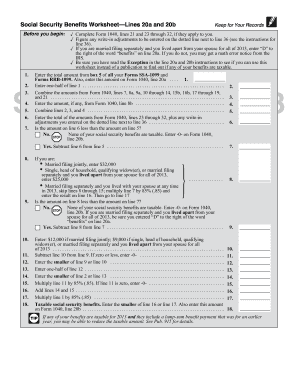

They complete worksheet 1 shown below entering 29750 15500 14000 250 on line 3. Enter the total amount from line a above on form 1040 or 1040 sr line 5a and enter 0 on form 1040 or 1040 sr line 5b. Combine the amounts from form 1040 lines 1 2b 3b 4b and schedule 1 line 22. If none of your benefits are taxable but you must otherwise file a tax return do the following.

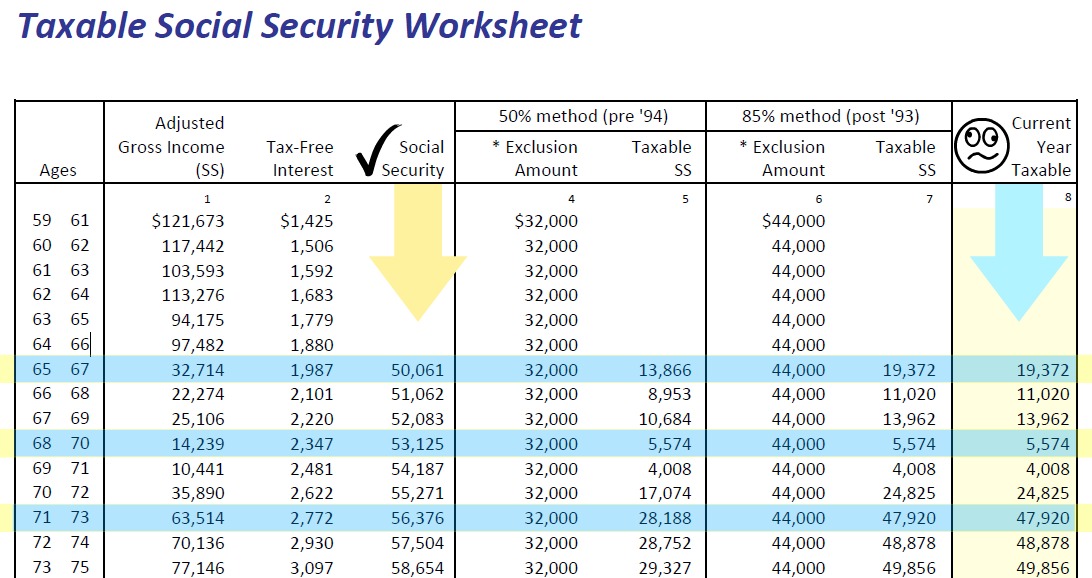

Social security benefits worksheet taxable amount if your income is modest it is likely that none of your social security benefits are taxable. Social security benefits worksheet 2018 before filling out this worksheet. If your combined income was more than 34000 you will pay taxes on up to 85 of your social security benefits. On form 1040 they enter 5600 on line 5a and 0 on line 5b.

They find none of rays social security benefits are taxable. Figure any write in adjustments to be entered on the dotted line next to line 36 schedule 1 form 1040. You generally owe social security taxes on the first 132900 of your 2019 gross income. 915 and social security benefits in your 2019 federal income tax return instructions.

Heres how to figure it out. Additionally the maximum taxable annual social security earnings for a taxpayer in 2017 was 127200 and the maximum annual social security tax for a taxpayer was 788640. Worksheet instead of a publication to find out if any of your benefits are taxable. For the 2019 and 2020 tax years single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their social security benefits.

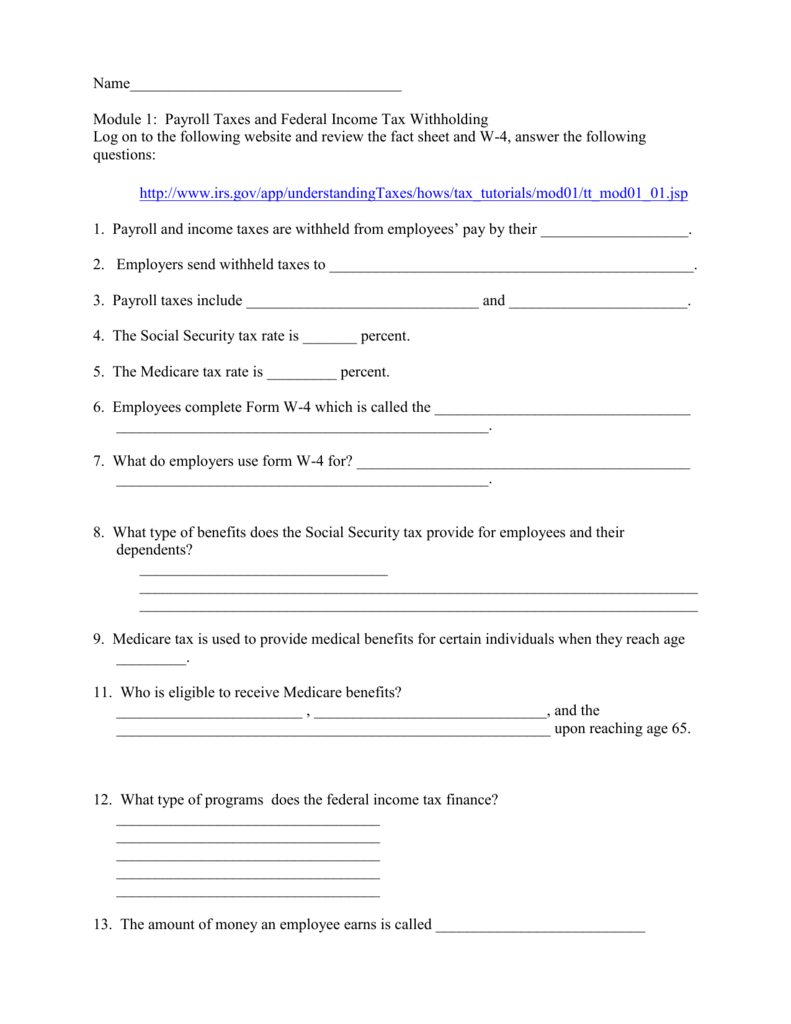

Ray and alice have two savings accounts with a total of 250 in taxable interest income. Also enter this amount on form 1040 line 5a. The social security tax rate is 62 percent for an employer and 62 percent for an employee or 124 percent total. As your gross income increases a higher percentage of your social security benefits become taxable up to a maximum of 85 of your total benefitsthe taxact program will automatically calculate the taxable amount of your social security income if any.

Some of the worksheets displayed are benefits retirement reminders railroad equivalent 1 30 of 107 2019 form w 4 your retirement benefit how its figured 2019 form w 4 2019 form w 4 form w 4p for teachers retirement system of the state of 2019 form w 4. The amount that you pay in social security taxes throughout ones working career is associated with the social security benefits that you receive later in life but the amount you contribute will not equal the amount of benefits to which you have access.

%20screen%201.jpg)