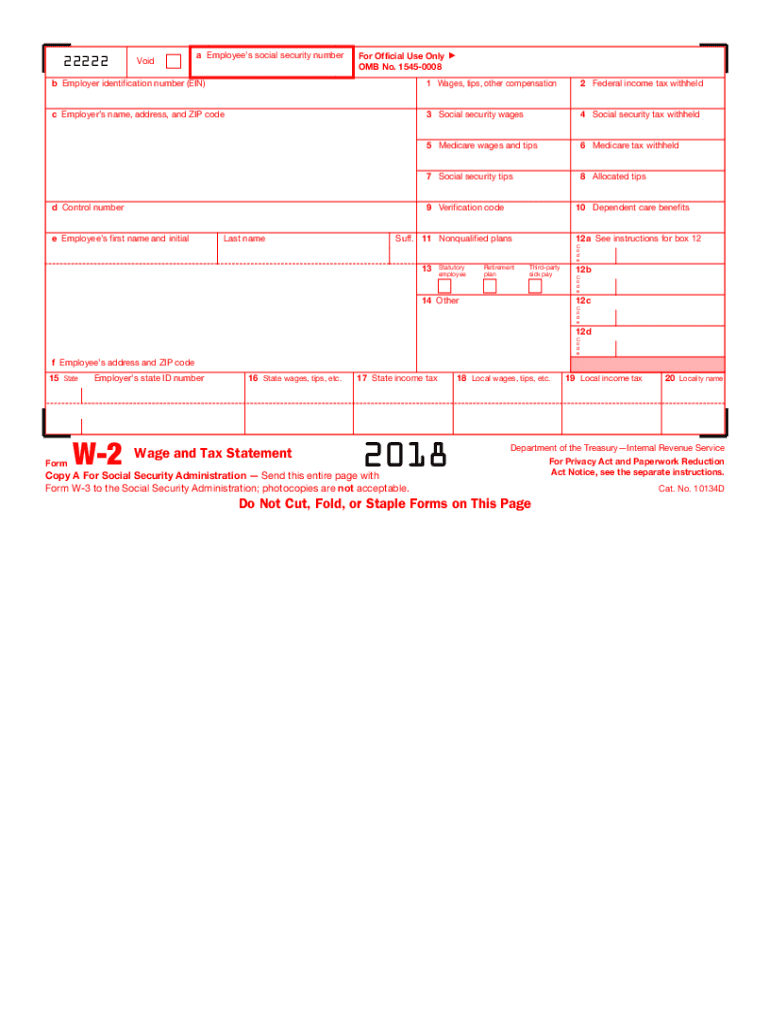

W 2 2018 Printable

Withholding will be most accurate if you complete the worksheet and enter the result on the form w 4 for the highest paying job.

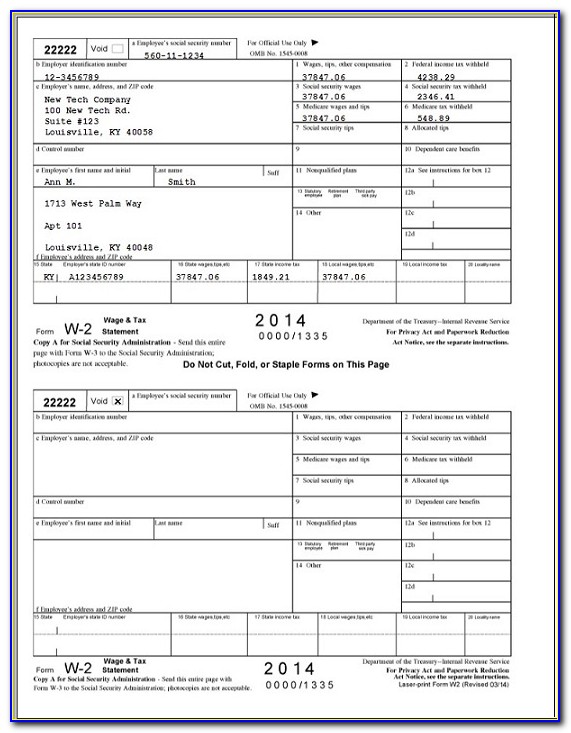

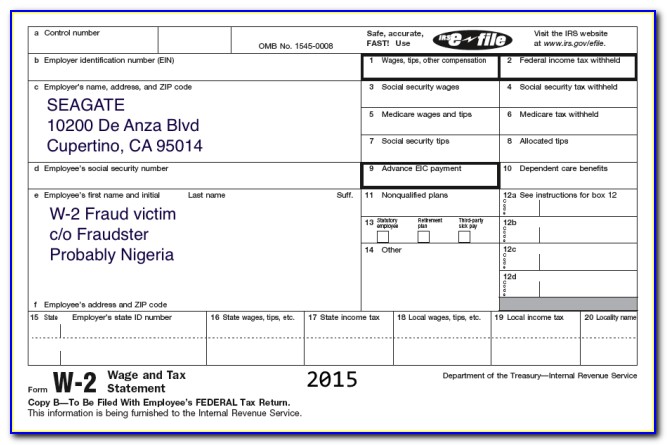

W 2 2018 printable. The irs w 2 or wage and tax statement is used to report wages paid to employees and the taxes withheld from them. What is w 2 form 2018. E file with ssa for 149 per form. Every american citizen who works as an employee and is paid a salary is obliged to prepare a w 2 form provided to him or her by their employers every year.

Department of the treasury internal revenue service forms website. Department of the treasury internal revenue service form also known as the wage and tax statementthe latest edition of the form was released in january 1 2018 and is available for digital filing. Create free fillable printable form w 2 for 2019. Download a pdf version of the irs form w 2 down below or find it on us.

Bureau of internal revenue 6115 estate smith bay suite 225 st. Forms w 2 and w 3 for filing with ssa. A w 2 form also known as a wage and tax statement is a form that an employer completes and provides to the employee so that they may complete their tax return. Form w 2 must contain certain information including wages earned and state federal and other taxes withheld from an employees earnings.

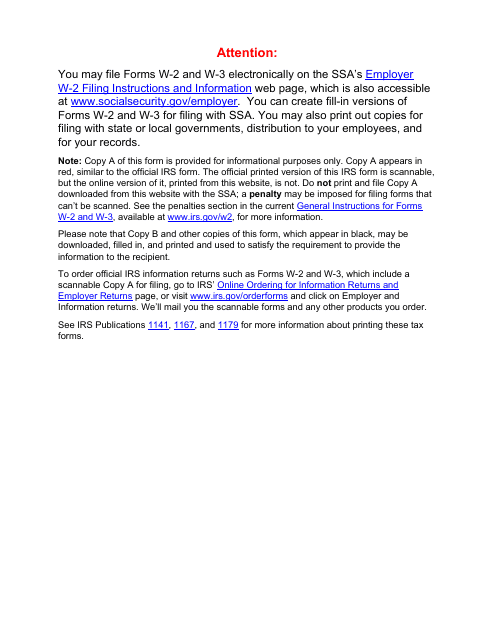

W 2 form 2018 online w2 form2018 is essential for filing returns of the respective year. Form w 2 is filed by employers to report wages tips and other compensation paid to employees as well as fica and withheld income taxes. Forms w 2 and w 3 for filing with ssa. You may file forms w 2 and w 3 electronically on the ssas employer w 2 filing instructions and information web page which is also accessible.

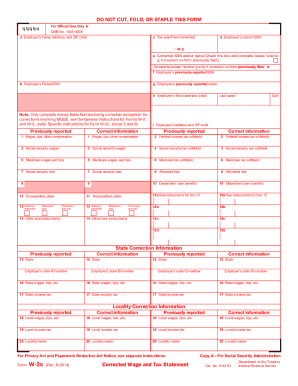

Copy a of this form is. Fill generate download or print copies for free. Irs form w 2 is a us. You may also print out copies for filing with state or local governments distribution to your employees and for your records.

Information about form w 2 wage and tax statement including recent updates related forms and instructions on how to file. Copy a for social security administration send this entire page with form w 3 to the social security administration. Forms w 2 must be provided to employees. If you choose the option in step 2b on form w 4 complete this worksheet which calculates the total extra tax for all jobs on only one form w 4.

You may also print out copies for filing with state or local governments distribution to your employees and for your records.