Printable 1099 And 1096 Forms

The separate instructions for filersissuers for form 1099 nec are available in the 2020 instructions for forms 1099 misc and 1099 nec.

Printable 1099 and 1096 forms. You can also choose to e file your 1099 forms to the irs. In the 1099 wizard that opens select get started. Do not send a form 1099 5498 etc containing summary subtotal information with form 1096. Follow the wizard then in the choose a filing method window select print 1099s.

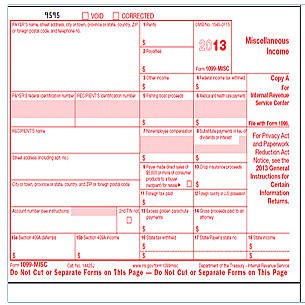

At the time of filing the taxes 1099 and 1096 forms have to be filled and submitted and hence it is important to print them for the business purposes. Form 1099 nec as nonemployee compensation. See the instructions for forms 1040 and 1040 sr or the instructions for form 1040 nr. You need not submit original and corrected returns separately.

In this piece we will describe the steps which take you to print the forms in sage 100. Do not send a form 1099 5498 etc containing summary subtotal information with form 1096. From the file menu choose print forms and then select 1099s1096. Map your accounts and edit thresholds if needed then select continue.

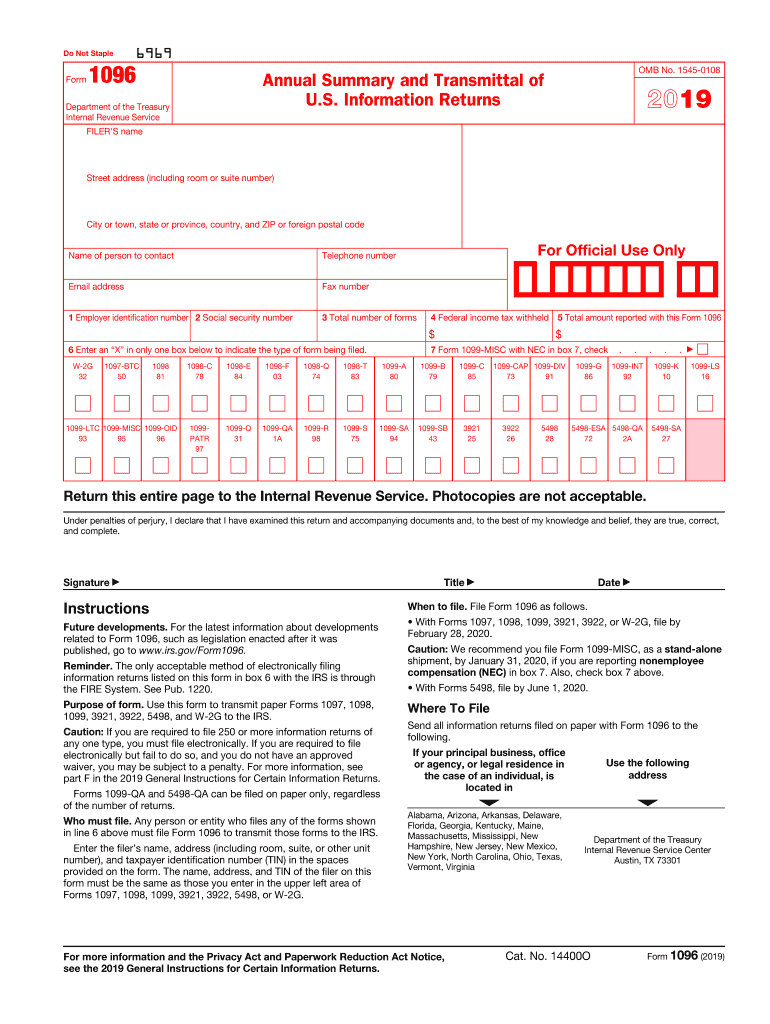

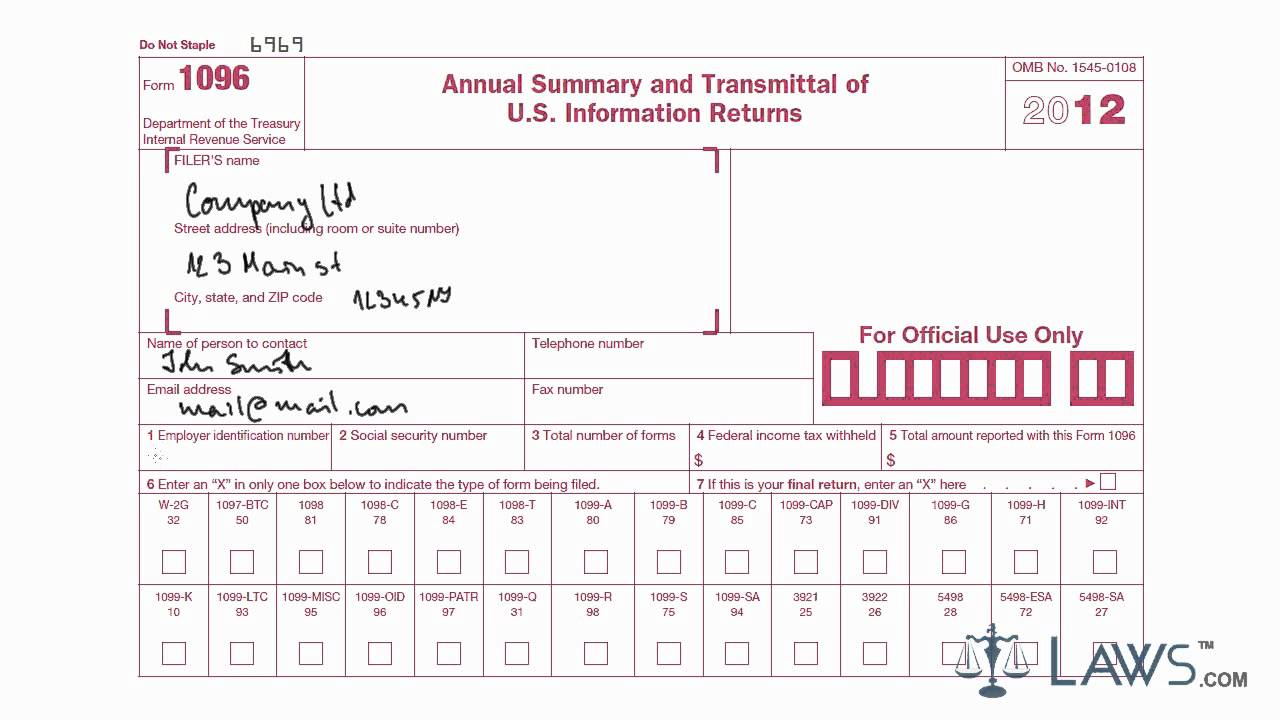

Use form 1096 to transmit paper forms 1097 1098 1099 3921 3922 5498 and w 2g to the internal revenue service. Visit the social security administrations employer reporting instructions and information website to complete and file electronic forms w 2 and w 3. You need not submit original and corrected returns separately. 1098 and another form 1096 to transmit your forms 1099 a.

Make sure that you have blank 1096 forms in the printer. You will need to submit a separate 1096 for every type of information return prepared even if you only prepared one of each kind. Forms can only be printed in single user mode and you must have pre printed 1099 and 1096 forms to perform this. Select your 1099 vendors and choose continue then verify your 1099 vendors information again choose continue.

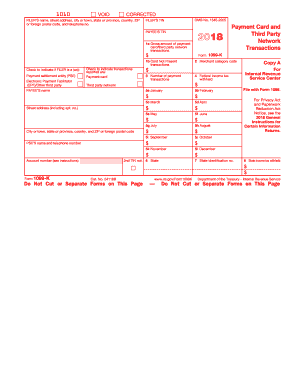

Form 1096 is used by filers of paper forms 1099 1098 5498 and w 2g to transmit copies to irs not used to transmit electronically. This income is also subject to a substantial additional tax to be reported on form 1040 1040 sr or 1040 nr. Verify your 1099 details. Forms 1098 and 1099 a complete one form 1096 to transmit your forms 1098 and another form 1096 to transmit your forms 1099 a.

For example if you prepared and submitted two 1099 misc forms and one 1099 r form for retirement payments you must submit a 1096 form summarizing the 1099 misc forms and another 1096 form summarizing the 1099 r. Want to file forms w 2w 2c and w 3w 3c electronically. Printing 1099 and 1096 forms in sage 100 can be relatively easy through the following procedure. Any amount included in box 12 that is currently taxable is also included in this box.

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

:max_bytes(150000):strip_icc()/1099_misc_form-569fcc0f5f9b58eba4ad3afa.jpg)